“Nothing in life is as important as you think it is while you are thinking about it.” Daniel Kahneman

Which major investment issue were you thinking about on March 11th 2016?* You probably can’t remember even though, at the time, it seemed incredibly important. Whilst most of us should be investing for the long-term, markets conspire against us; lurching from one obsession to the next, drawing our gaze and enticing us to take action.

As the news about a particular event or development takes centre stage, and experts hold forth about the potential outcomes, the notion of doing nothing can seem ridiculous. The issues are, by definition, salient, recent and available; all factors which make it very difficult for us to have any reasonable perspective on their long-term significance.

It is not that matters such as war on the Korean Peninsula / peace on the Korean Peninsula or Italy leaving the EU are not meaningful (to take recent fascinations), but, from an investment perspective, there is very little most investors can do to benefit. Each year there is a succession of topics that we become excessively diverted by, where the temptation to act is strong; but before we do, we should try to answer the following three questions:

1) Does it matter to returns? Given that we tend to hugely overstate the importance of the issue that we are currently focused on, we are likely to assume far more things matter to long-term returns than actually do. It is vital to remember that the historic long-term returns of major asset classes inevitably include periods of tumult at least as significant as the one that currently has our rapt attention.

2) What is going to happen? Even if we are confident in the view that returns will be impacted by a given issue, we then have to predict what the outcome will be. I think enough has already been said about our ability to forecast such things.

3) How will it impact markets? In the unlikely event that we have identified an event that will materially alter asset class returns and successfully envisaged the outcome, we then need to understand how markets will react. Markets are reflexive and unpredictable. Do we really know how other investors will behave or what’s in the price?

In simple terms, such activity is incredibly difficult to get right, particularly on a consistent basis. Even if we have the foresight to identify which events truly matter amidst the clamour – we then need to forecast a particular outcome and the response of markets. Whilst some professional investors specialise in this activity, most of us should avoid such heroics.

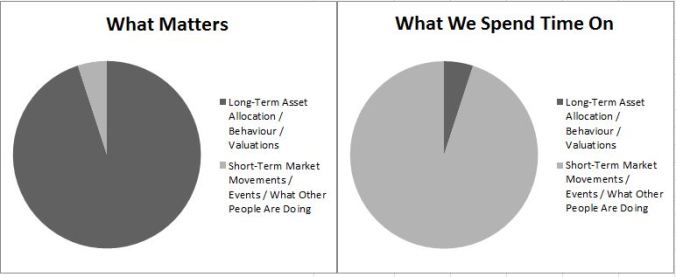

This is easier said than done. Financial markets create a cacophony of noise and a flow of narratives that we find irresistible; a vicious circle forms where even if we want to disregard an issue, we cannot because it is considered unacceptable to do so. How can you be ignoring something that is so prominent and material? Action and opinion are incredibly highly valued, even if their true worth is often negative. Thus, we end up in a situation where investors spend the vast majority of their time on things that don’t matter and not enough on the things that do. I imagine the breakdown of investor attention as being something akin to this (entirely unscientific):

Having an asset allocation that is suitable for your requirements, considering valuations and thinking about how best to control your behaviour is the surest way to deliver solid results, whilst avoiding the most common investment mistakes. Taking a long-term approach doesn’t mean you should set once and forget, rather think carefully about your time horizon when making decisions and don’t check your portfolio too regularly. Doing nothing should be a strong default.

Investing for the long-term seems easy until you understand that it is comprised of many days and many more temptations. Financial markets will do their utmost to lure you toward the rocks, be sure to tie yourself to the mast.

* This is a random date, I have no idea what particular issues I was being distracted by at the time.

Pingback: Tim's Top Links - 6/14/18 | Mullooly Asset Management

Pingback: Serendipity, Binge Factories and World Cup Winners – My Blog

Pingback: Serendipity, Binge Factory dan Pemenang Piala Dunia | Dokter Finansial

Pingback: Happy Hour: Tracking Index Returns Via ETFs • Novel Investor

Pingback: Почему инвесторы сосредотачиваются на неправильных вещах? | Акционер XXI века (myinvestpro.ru)